Who Are House Investors?

A professional house investor is either a business or an individual who buys properties with the goal of making money. Individual investors tend to own one or two investment homes. They’re either a landlord who keeps and rents out the properties or a flipper who upgrades homes with quick turnaround time to get them back on the market. Individuals are also investing in homes for AirBnb vacation rentals. Companies that buy houses usually invest in more than one or two homes but maybe not all at once (it really depends on the size of the company).

There are several strategies when it comes to investing in houses for investor companies. Let’s explore a few of them…

Wholesale Investors

Wholesalers buy properties only to resell the housing contract very quickly without making any improvements. They buy houses well below market value, with the goal of selling to another investor for a higher price. Successful wholesalers usually have a large list of buyers and utilize direct marketing to identify off-market homes they can buy under market value.

House Flip Investors

Flippers buy homes with the intention to renovate and then sell on the MLS for a higher price. The goal is to be able to sell for more than it was initially worth and profit after accounting for the expenses to upgrade.

Buy And Hold Investors

These investors are interested in growing their portfolio and could rent out the property as a side hustle. The main idea here is cash flow, so an investor will not buy and hold unless their potential profit minus expenses is positive. In a high appreciation area, an investor may buy and hold even if they are just breaking even– it’s a long-term strategy.

Hybrid Investors

Some investors are a combination of buy and hold investors and house flippers. They are known primarily to buy houses, rehab the house, refinance the house, and then repeat this process on another house. This is commonly referred to as the BRRR (Buy, Rehab, Refinance, Repeat) Method.

What To Know Before Selling Your House To An Investor

Is A Property Investor Right For Me?

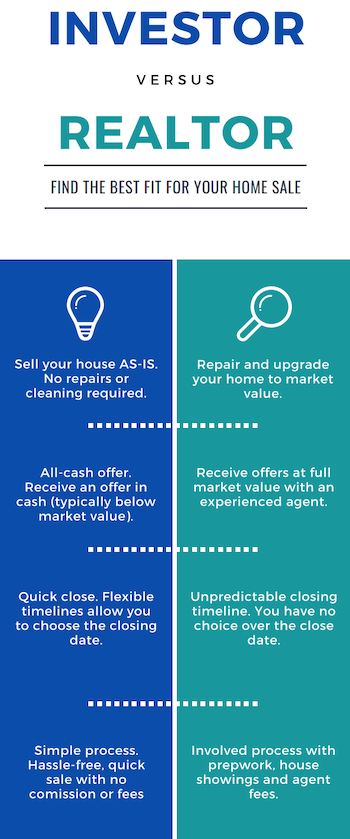

Selling to an investor saves time and hassle, but it’s not for everyone. If your home is in immaculate condition and you want full market value, you are better off listing on the MLS with a real estate agent. If you don’t have the time, money, or energy to fix your home up to the comparables in the neighborhood and are willing to settle for less than market value because of this, an investor is a great option.

Personal situations, like a job relocation, divorce or potential foreclosure, are some common reasons people end up quickly selling a home to an investor.

You can expect a quicker close, an as-is sale and an all-cash offer. Investors have the money and can work on your schedule. It’s a convenient option if you’re willing to take a little less for your home. You don’t have to repair anything.

When selling to an investment company without a listing agent, you need to do your research to protect yourself from scams. There are plenty of companies that buy houses — make sure to use a reputable one.

Are There Any Costs When Selling To An Investor?

Every time you sell your home whether it’s on the MLS or to an investor, there will be closing costs involved. Many investors have the seller cover these costs, however seasoned investors will cover these costs for you. This is a great question to ask home investors before signing a contract. When using an agent, you typically will pay at least a portion of the closing costs (~2% of the sale price).

How Much Will An Investor Pay For My House?

This is the ultimate question that everyone wants to know, but it really depends because every house has something different going on. It also depends on how creative the investors are with figuring out solutions for your home situation. If you’re looking for all cash and your home has repairs waiting to be made, an investor will calculate the After Repair Value (ARV) and subtract the estimated cost to make repairs along with the closing costs and profit margin.

The best way to figure out what an investor will offer is to find the comparables in your neighborhood using sites such as Zillow and RedFin (note that these free sites don’t always provide the most accurate comps, especially in rural areas). You can then estimate how much money you would need to spend to upgrade your house to those comps. Beyond this estimation, it’s typically free to get multiple offers from different investors, and you should ask for an in-depth look at how they came to their offer price. Investors use expensive software to find the most accurate comps (they probably know what your house will sell for better than you).

When selling your home to an investor, it’s to your advantage to ask questions and fully understand your offer before making a decision.

Why Sell Your Home To An Investor?

![]() Close On Your Schedule

Close On Your Schedule

Home investors don’t use traditional financing. They specifically always pay cash to have a flexible timeline when it comes to closing. This is very different from listing with a real estate agent where you have little to no control on the closing date. It’s worth noting that this works in both directions– investors can close fast (some in as little as 7 days), or investors can extend the date to give the seller time to find a new home first.

![]() All Cash Offer

All Cash Offer

Investors will typically offer all cash, which is great if that’s what you’re looking for from your home sale. You should note that investors will not be able to offer market value with this all cash offer because the repair and sales costs as well as a profit margin must be accounted for in the offer.

![]() No Repairs Required

No Repairs Required

Homeowners don’t have to repair, upgrade, or clean at all before selling their property to a house investor. You can even leave your unwanted belongings in the home. There is zero prepwork, which saves homeowners both money and time that can be used for higher priorities such as searching for your next home.

![]() Simple Process

Simple Process

There is no complex process when selling to a house investor. Most cash-for-house processes starts with the seller filling out a form followed by a phone call with the company so the investor can get to know your property better and then make you an offer. From there, you can take it or leave it. If you choose to take it, you set the close date and your house is sold.

![]() No Commission Or Fees

No Commission Or Fees

Home investors are not licensed agents, so there is no commission or fees to be paid. Many home investors will cover the closing costs in addition to the all cash offer. This is roughly 2% of the sale price that the seller would typically have to cover when dealing with an agent, but not with a property investor.

Cons Of Selling To An Investor

![]() Offers Below Market Value

Offers Below Market Value

Investors’ offers are all cash, and they need at least a little profit, so investors cannot offer market value. If your home is in great condition and you have a flexible timeline, selling to a home investor is probably not your best option. House investors work well when there are repairs to be made and the seller doesn’t have the time, energy, or money to prepare his/her home for the market.

![]() House Investor Scams

House Investor Scams

Not all home investors are to be trusted. There are no licenses or certifications required to be an investor company, so make sure to do your research before accepting an all cash offer.

How To Avoid House Investor Scams

If you decide not to have a listing agent represent you, you’ll need to do research to make sure the offer you’re considering is legitimate and that you aren’t being taken advantage of. Here are a few important steps you should take…

- Call their office. Use the published number you were provided and ask to speak with the owner. Inquire about past home investments and your other options beyond a cash home buyer (a genuine property investor is willing to discuss all of your options because they have your best interests in mind). You should also ask if they use a standard contract or if they draft their own. If the contract is not standard, you should carefully review it to ensure there is nothing that will put you, the seller, at a disadvantage.

- Check their website. Look for photos of the owners and pictures of homes they have sold or flipped. If they don’t have a website, ask the investor if they have any materials to support their business claims.

- Read reviews online. Most professional investors, even small investment companies, have some sort of online presence such as on Google or Facebook. Reviews can be fake, but thoughtful responses to these reviews typically come from credible companies.

- Verify closing agent. All transactions should take place through a closing or escrow agent. Ask for the name of the title company you’re closing with so you can do your own research.